Managing Your Jeep Wrangler Monthly Payment: Tips for Financial Success

Are you ready to hit the road in style?

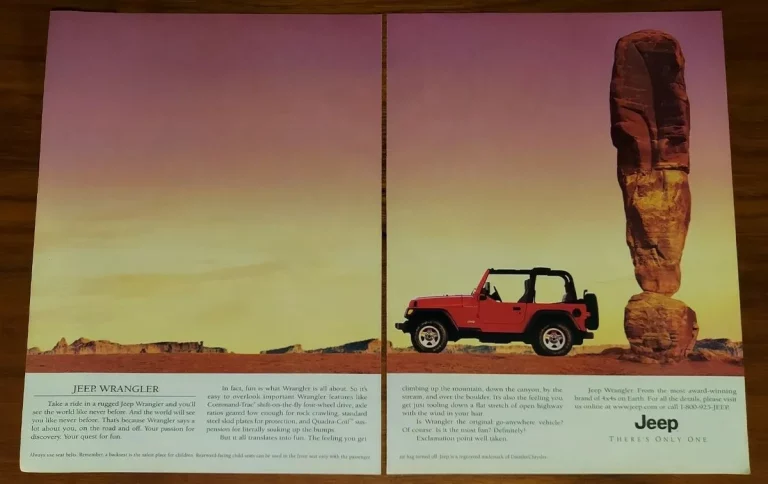

Imagine cruising down the highway, wind in your hair, with the ruggedness of a Jeep Wrangler beneath you.

But wait, what if I told you that this dream could become a reality for just $644 a month?

That’s right, with a small down payment and a few signatures, you could be the proud leaseholder of a Jeep Wrangler.

Intrigued?

Read on to discover all the details and start planning your next adventure.

jeep wrangler payment monthly

The monthly payment for a Jeep Wrangler on a lease is $644.

This lease requires a $1,000 down payment and a total due at signing of $1,644.

The total cost to the lessee over the 36-month lease term is $24,175.

This amount does not include sales tax, title, registration, and other fees.

The lessee is responsible for vehicle maintenance, insurance, repairs, and charges for excess wear and tear.

Actual monthly payments may vary and higher lease rates apply for lessees with lower credit ratings.

Please note that these lease programs are in effect through January 31, 2024.

Key Points:

- Monthly payment for Jeep Wrangler lease: $644

- Down payment: $1,000; total due at signing: $1,644

- Total cost over 36-month lease term: $24,175

- Additional costs not included: sales tax, title, registration, and other fees

- Lessee responsible for vehicle maintenance, insurance, repairs, and excess wear and tear charges

- Lease rates may vary and higher rates apply for lessees with lower credit ratings

Check this out:

💡 Did You Know?

1. The Jeep Wrangler was first introduced in 1986 as a direct descendant of the famous World War II Willys MB Jeep, which played a crucial role in the Allied victory.

2. Did you know that in 2018, the average monthly payment for a Jeep Wrangler in the United States was around $452? This figure can vary depending on factors such as model year, trim level, and down payment.

3. The Jeep Wrangler’s iconic seven-slot grille is not just a design choice; it has historical significance. It pays homage to the Willys MB, which also featured a seven-slot grille and is regarded as a symbol of Jeep authenticity.

4. Ever wondered about the origin of the term “Jeep”? The exact etymology remains a subject of debate, but one theory suggests that it was inspired by the character “Eugene the Jeep” from the 1936 Popeye cartoon, who had the magical ability to solve seemingly impossible problems.

5. The Jeep Wrangler is specifically designed for off-road adventures, and one of its unique features is the ability to legally remove the doors. Jeep owners can easily detach the doors for a more thrilling and immersive experience while enjoying the great outdoors.

Lease Payment Details For A Jeep Wrangler: $644/Month For 36 Months

The lease payment details for a Jeep Wrangler offer an attractive option for those looking to drive this iconic off-road vehicle without committing to a long-term purchase. With this lease agreement, you can enjoy the rugged capabilities and stylish design of the Jeep Wrangler while making monthly payments of $644 over a period of 36 months. This allows for better budgeting and flexibility compared to traditional financing options.

However, it is important to note that this monthly payment amount is an estimate and may vary based on factors such as credit rating and lease program terms.

- Monthly payments of $644 over 36 months

- No long-term commitment

- Better budgeting and flexibility

Down Payment And Signing Fees For The Jeep Wrangler Lease

To secure the Jeep Wrangler lease, a down payment of $1,000 is required. Additionally, there are signing fees amounting to $1,644, which includes the down payment, the first month’s payment, and a $0 security deposit.

While it is common for leases to require a down payment and signing fees, the relatively lower amount of $1,000 makes it more accessible for individuals who may not have a substantial upfront cash reserve.

This helps in reducing the initial financial burden and enables you to drive away in your dream Jeep Wrangler sooner.

- Down payment: $1,000

- Signing fees: $1,644 (includes down payment, first month’s payment, and $0 security deposit)

Total Cost To Lessee Over The Lease Term

Over the 36-month lease term, the total cost to the lessee amounts to $24,175. This figure takes into account the monthly payments of $644, along with the down payment and signing fees.

It is important to understand that this total cost does not include sales tax, title, registration, and other fees, which may vary depending on your location.

By calculating the total cost, you can assess the feasibility of the lease agreement and make an informed decision based on your financial situation and objectives.

- The total cost to the lessee over the 36-month lease term is $24,175.

- This amount considers the monthly payments of $644 and the down payment and signing fees.

- Please note that sales tax, title, registration, and other fees are not included in this figure.

- These additional fees may vary depending on your location.

“By calculating the total cost, you can assess the feasibility of the lease agreement and make an informed decision based on your financial situation and objectives.”

Exclusions From The Lease Cost

It is important to be aware of the exclusions from the lease cost. The lease price of $24,175 includes the lease payments and upfront fees, but it does not cover other expenses like sales tax, title, registration, and other fees. These additional costs can vary based on state and local regulations, as well as individual circumstances. To get an accurate idea of the overall expenses associated with the Jeep Wrangler lease, it is advisable to consult with the dealership or lease provider to determine the exact amount of these exclusions.

Improvements:

- Exclusions from the lease cost:

- The lease price of $24,175 only includes the lease payments and upfront fees.

- It does not cover additional expenses such as sales tax, title, registration, and other fees.

- Variability of additional costs:

- The costs mentioned above can vary depending on state and local regulations, as well as individual circumstances.

- Consultation for accurate budgeting:

- To have a more accurate representation of the overall expenses, it is prudent to consult with the dealership or lease provider.

- They can provide the exact amount of the exclusions mentioned above.

Lessee Responsibilities For The Jeep Wrangler Lease

As the lessee of the Jeep Wrangler, it is important to understand your responsibilities beyond the monthly payments.

- You are responsible for vehicle maintenance, insurance, repairs, and charges for excess wear and tear.

- Ensure that the Jeep Wrangler is properly maintained.

- Have it insured according to your state’s requirements.

- Cover the costs of any repairs that may arise during the lease term.

- Charges may apply for any excessive wear and tear beyond normal usage, highlighting the importance of taking good care of the vehicle throughout the lease period.

Variations In Actual Monthly Payments

Although the estimated monthly payment for the Jeep Wrangler lease is $644, it is important to note that actual monthly payments may vary. Factors such as credit rating, lease program terms, and negotiations with the dealership can impact the final payment amount.

Higher lease rates may apply for lessees with lower credit ratings, potentially resulting in a higher monthly payment. On the other hand, favorable credit ratings and lease program terms may enable you to negotiate a lower monthly payment.

Therefore, it is advisable to:

- Explore financing options

- Engage in discussions with the dealership

This will help determine the most suitable and affordable monthly payment based on your unique circumstances.

Remember: The estimated monthly payment serves as a starting point, but working closely with the dealership can lead to finding better payment options.

Higher Lease Rates For Lessees With Lower Credit Ratings

Important Point: Higher lease rates are applied to lessees with lower credit ratings.

In the leasing industry, it is common practice for lessors to charge higher lease rates to lessees with lower credit ratings. This is done as a way to minimize the risk for the lessor. Lower credit ratings suggest a greater possibility of default or late payments, which could lead to financial losses for the lessor.

Lessees with lower credit ratings may therefore encounter higher interest rates or monthly payments. Nonetheless, it is crucial to remember that lease approval is not solely determined by creditworthiness. Other factors, such as income and employment history, are also taken into account during the evaluation process.

To summarize:

* Higher lease rates are typically charged to lessees with lower credit ratings.

* This practice helps mitigate risk for the lessor.

* Lower credit ratings imply a higher likelihood of default or late payments.

* Individuals with lower credit ratings may face higher interest rates or monthly payments.

* Creditworthiness alone does not determine lease approval; other factors such as income and employment history are considered.

“Higher lease rates apply for lessees with lower credit ratings. This is a standard practice in the industry as a way to mitigate risk for the lessor.”

- Higher lease rates are typically charged to lessees with lower credit ratings in the leasing industry as a way to mitigate risk for the lessor.

- Lower credit ratings may indicate a higher likelihood of default or late payments, resulting in financial losses for the lessor.

- Lessees with lower credit ratings may experience higher interest rates or monthly payments.

- Creditworthiness is not the sole determining factor for lease approval.

- Other factors like income and employment history are taken into consideration as well.

Lease Program Terms In Effect Through January 31, 2024

The lease program terms for the Jeep Wrangler are in effect through January 31, 2024. It is important to be aware of the expiration date of the lease program, as this may affect the availability of the offer and the associated terms. Therefore, if you are considering leasing a Jeep Wrangler, it is recommended to take advantage of this program before the specified date.

Keep in mind that lease program terms are subject to change, and it is advisable to consult with the dealership or lease provider to confirm the current terms and conditions. By staying informed about the program’s expiration date, you can make an informed decision and secure the most beneficial leasing arrangement for your needs.

- Be aware of the expiration date of the lease program for the Jeep Wrangler

- Take advantage of the program before January 31, 2024

- Consult with the dealership or lease provider to confirm the current terms and conditions

FAQ

How much do you pay monthly for a Jeep Wrangler?

The monthly payment for a 2024 Jeep Wrangler is estimated to be around $919. As for the total cost, it includes a down payment, first month payment, and no security deposit, which amounts to $1,919 due at lease signing. Over the lease term, the lessee will be paying a total of $34,081, excluding additional fees such as sales tax, title, registration, and others.

How much of a down payment do I need for a Jeep Wrangler?

The down payment amount for a Jeep Wrangler typically follows the general rule of 20 percent of the vehicle’s price. This means that, in order to purchase a Jeep Wrangler, you would need to pay 20 percent of its total cost as a down payment. This down payment requirement is beneficial as it helps reduce your overall loan amount and may improve your chances of getting approved for financing.

How much should I pay for a new Jeep Wrangler?

When purchasing a new Jeep Wrangler, the pricing will depend on the specific model and options you choose. Starting at $31,895, the base price includes two doors, while opting for four doors will increase the price by $4,000. If you’re interested in the Wrangler 4xe plug-in hybrid, it is only available with four doors and begins at $49,995. Keep in mind that additional features and customizations can affect the final price, allowing you to personalize your Jeep Wrangler to your preferences.

How much is a downpayment on a Jeep?

The recommended down payment for a Jeep generally falls between 10 to 20 percent of the vehicle price. However, opting for a larger down payment can lead to further savings on interest payments throughout the loan’s duration. By saving up a substantial down payment, you can reduce the principal amount borrowed and potentially enjoy a lower interest rate, ultimately leading to long-term cost savings.